Tax bills explained by Lake County Commissioners

Hey savvy news reader! Thanks for choosing local.

You are now reading

1 of 3 free articles.

News from the

Lake County Commissioners

Lake County tax bills will be mailed out to property owners at the end of October. Many people have questions regarding their tax bills. This article will attempt to give you some useful information on that topic. If you have questions or comments please feel free to call the Commission at 406-883-7204.

The Montana State Department of Revenue is charged with valuation of property. Please see this website, http://revenue.mt.gov/Portals/9/property/forms/understanding_property_taxes_general-2014.pdf, for more information on how the department values properties and how the state taxes collected are used. The reappraisal cycle started January 1, 2015. The 2015 Classification and Appraisal Notices were mailed to property owners in the spring and summer of 2015.

The State sets the dollar value of each mill per the assessed values of property in the County. The Lake County Commissioners set the number of mills to be collected based on the County budget needs. The law does set a cap that the County cannot go over without a vote of the people.

Funds that are voted in by the voters are set by the ballot language. If they are voted at a set number of mills the dollar amount will fluctuate as the assessed values change. Funds that are voted in at a set amount of dollars will cause the number of mills to fluctuate. For example, Lake County and Swan Search and Rescue receive a voted levy of 2 mills. The amount of money they receive will change as the value of a mill changes.

How the money is allocated from mills is often specified by law. For example, we cannot take money that is collected for senior citizens and give it to roads.

Lake County prepares the annual budget thereby deciding the number of mills needed to collect to bring in the revenues necessary to provide county services. Some examples of these services are Public Safety, Roads and Elections. When you look at your tax bill, please take note of how much you are paying toward roads, schools, public safety, etc.

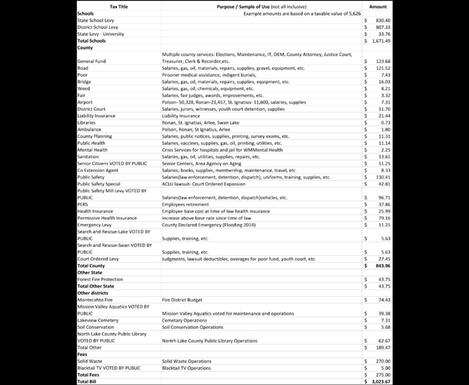

Below is an example of the line items you may see on your tax statement and how they are commonly used: