- Home >

- News >

- Local News

Buyback offers will roll out Sept. 5

Nicole Tavenner

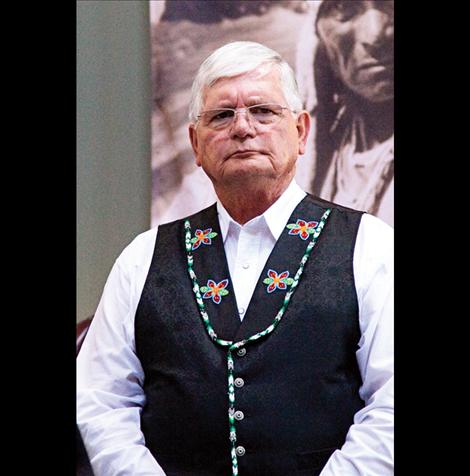

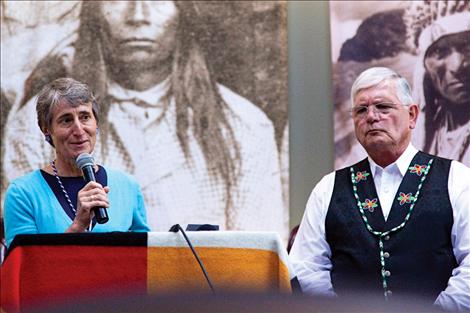

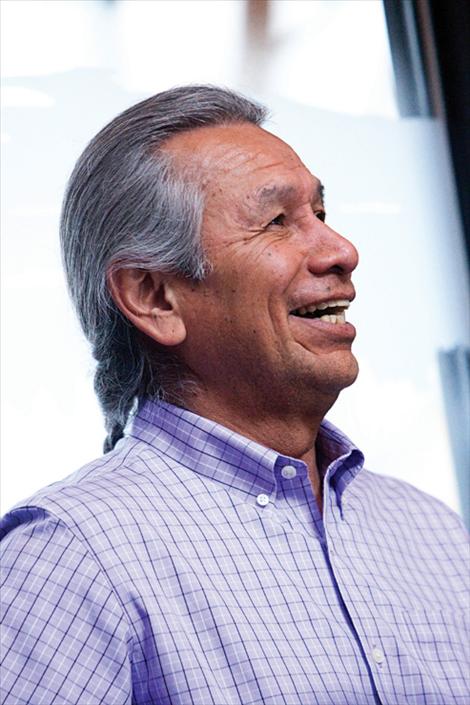

Confederated Salish and Kootenai Tribal Councilman Vernon Finley chats with Secretary of the Interior Sally Jewel before a press conference announcing the rollout of a land buyback program.

Nicole Tavenner

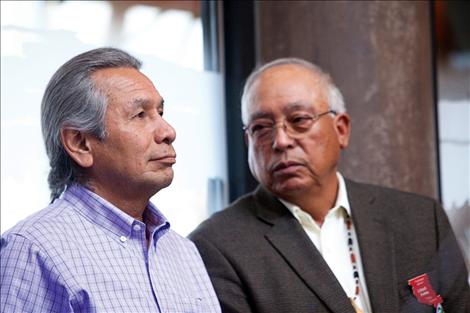

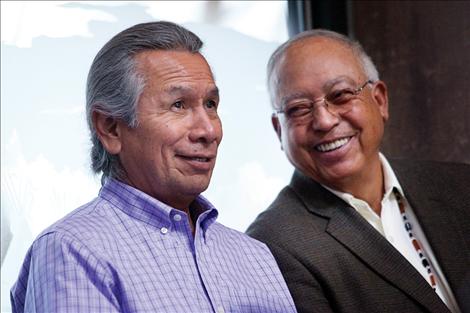

Senator Jon Tester

Nicole Tavenner

CSKT Chairman Ron Trahan

Nicole Tavenner

US Secretary of the Interior Sally Jewell

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Nicole Tavenner

Issue Date: 8/27/2014

Last Updated: 8/26/2014 5:33:30 PM |

By

Megan Strickland

Keep Reading!

You’ve reached the limit of 3 free articles - but don’t let that stop you.