Funny money: Theater teaches finance to schoolchildren

Hey savvy news reader! Thanks for choosing local.

You are now reading

1 of 3 free articles.

RONAN – Compound interest, credit, and saving money are complex topics of financial literacy that the majority of America’s adults struggle to understand and execute. According to the Federal Reserve, in 2013, households on average have $15,185 in credit card debt, $147,133 in mortgage debt, and $31,509 in student loan debt. A July 2013 report from Bankrate.com revealed that 27 percent of Americans have no savings at all.

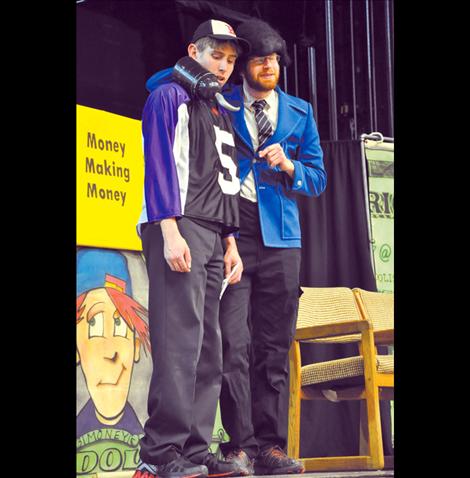

The stakes of learning financial literacy at a young age are getting higher. By age 18, almost one third of students will have a credit card, according to actor Sam McCalla of the National Children’s Theater. The group performed the play “Mad About Money” for students at Ronan Middle School on Oct. 8.

Dr. Lewis Mandell, a scientific researcher, found children’s viewpoints on personal finance can be positively influenced by live theater performances explaining basic money management skills. With that research in mind, Carey Swanberg, dean of students at Ronan Middle School, said she was excited when she was asked if the theatrical performance could come to the school for free.

“It seemed like a great opportunity for our students to learn about money,” Swanberg said.

During the performance, two actors used a script with improvisation based on the response of the audience. Through a series of hilarious skits that kept both students and teachers rolling with laughter, the performance stressed the importance of weighing needs versus wants, saving, budgeting and consequences of borrowing.

“The actors are fabulous about taking suggestions from the audience, building it into the action of the play and turning them into punch lines,” Monica Lindeen, commissioner of securities and insurance, said in a press release. “It makes a tremendously funny show but it still delivers a clear and important message about creating good money habits – something we want our young people to develop as early in life as possible.”

According to Montana Office of Public Instruction spokesperson Allyson Hagen, there is no requirement for Montana school children to take a class focused completely on financial literacy before graduation.

“There are parts of our different subject area standards that speak to financial literacy,” Hagen said. “There are mentions of it both in the career and technical education standards and in social studies standards. In many schools (students) would get that under business education or family and consumer science education.”

Ronan students learn money concepts in the fourth and fifth grades, according to Swanberg.

This year was the second year that the Montana Financial Education Coalition sponsored the theater show for schools across the state.